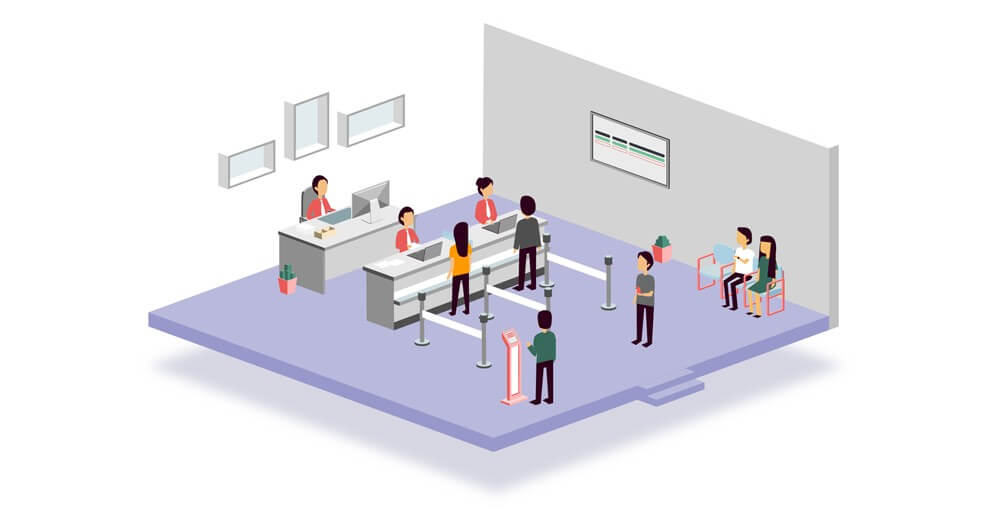

The integration of Information Technology (IT) into the financial sector has triggered a paradigm shift in how banking services are delivered and managed. This digital transformation, championed by industry leaders like Aristostar, is not just a trend but a necessity in today’s fast-paced, customer-centric world. Among the myriad technological advancements that have been embraced by banks, the implementation of Electronic Queue Systems (EQS) stands out as a critical tool in enhancing customer experience and operational efficiency. These systems, often implemented by companies such as Aristostar, have redefined how banks handle customer flow, manage resources, and provide services, leading to a more streamlined and effective banking experience.

The Evolution of Customer Service in Banking

Historically, banking was synonymous with long wait times, crowded branches, and manual processes that often left customers frustrated. The traditional queue system was inefficient, as it did not account for the varying complexities of different banking services or the specific needs of individual customers. With the advent of EQS, banks have been able to automate and optimize the entire customer service process, addressing these long-standing issues and setting new standards for service delivery.

Electronic Queue Systems are more than just a means to organize queues; they are comprehensive solutions that enhance the overall management of customer interactions. By leveraging technology, banks can now offer personalized, efficient, and timely services, which are crucial in retaining customer loyalty in an increasingly competitive market.

Functional Capabilities of Electronic Queue Systems in Banks

Under a relatively simple hardware setup, Electronic Queue Systems offer sophisticated software functionalities that automate and enhance customer service processes in banking. Here are some of the key features and benefits that EQS brings to the banking industry:

1. Specialization of Workstations

One of the core features of EQS is the specialization of workstations. In a typical bank setting, customers require a wide range of services, from simple transactions like cash withdrawals to more complex processes like loan applications or investment consultations. The EQS allows banks to direct customers to specific employees who specialize in the service they need. For instance, a customer needing assistance with a mortgage application will be directed to a mortgage specialist rather than a general teller.

This specialization not only improves the accuracy and quality of service but also ensures that customers are served by the most knowledgeable staff member available. Additionally, the system can prioritize service delivery based on the complexity or urgency of the request, ensuring that critical tasks are handled swiftly and efficiently.

2. Routing of Services

EQS also excels in managing multi-step service processes through its routing capabilities. Many banking services require customers to interact with multiple departments or service points within a single visit. For example, opening a new deposit account might involve interacting with an account manager, a cashier, and then returning to the manager for final documentation.

The EQS automates this process by routing customers through the necessary steps in the correct order. After the initial interaction, the system automatically directs the customer to the next available service point, minimizing confusion and ensuring that the entire process is completed smoothly and efficiently. This not only enhances the customer experience but also reduces the workload on staff by eliminating the need for manual coordination.

3. Delaying Customer Service

Customer needs can vary, and sometimes a customer may need extra time to fill out forms or gather necessary documents before continuing with a service. In such cases, the EQS provides the ability to delay the service temporarily. The bank operator can pause the service for a set period, allowing the customer to complete their tasks without losing their place in the queue. Once the time delay has elapsed, the system automatically recalls the customer, allowing the service to resume seamlessly.

This feature is particularly useful in preventing bottlenecks at service points, as it allows the operator to continue serving other customers while the delayed customer completes their paperwork. This flexibility ensures that the bank can maintain a steady flow of customers, reducing overall wait times and improving efficiency.

4. Selecting Multiple Services

Modern banking often involves customers needing multiple services during a single visit. Traditionally, this would mean waiting in separate queues for each service, leading to increased wait times and customer frustration. With EQS, customers can select all the required services at once using a single ticket number. The system then manages their journey through the bank, directing them to the appropriate service points in an optimized sequence.

For example, a customer who needs to make a deposit, apply for a credit card, and update their personal information can do so without having to re-register or wait in multiple lines. The EQS will call them to the first available service point and continue guiding them through the remaining services as efficiently as possible. This not only saves time but also enhances the overall customer experience by reducing the hassle of multiple queuing.

5. Client Priority

In today’s competitive banking environment, providing personalized service to high-value clients is crucial for maintaining customer loyalty. The EQS can be configured to prioritize certain categories of clients, such as VIPs or holders of premium accounts. These clients are automatically moved to the front of the queue for their selected services, ensuring that they receive prompt attention.

This feature can be particularly beneficial for banks that serve a large number of high-net-worth individuals or corporate clients, as it helps in maintaining strong relationships with these valuable customers. Identification for priority service can be facilitated through the use of bank cards, with the registration terminal equipped with card readers to recognize and prioritize these clients automatically.

6. Pre-registration

One of the most significant advancements brought by EQS is the ability for customers to pre-register for services. Through the bank’s website or mobile application, customers can book their appointments in advance, selecting a convenient time for their visit. Upon arrival at the branch, they can activate their registration by entering a unique code or scanning a barcode at the terminal.

Pre-registration not only reduces the time spent waiting at the bank but also allows the institution to manage customer flow more effectively. By knowing in advance how many customers are expected at specific times, the bank can allocate resources more efficiently, ensuring that staffing levels are appropriate for the anticipated demand.

7. SMS Notification

Waiting in line can be a significant source of frustration for customers, especially during peak hours. To mitigate this, EQS offers an SMS notification feature that alerts customers when their turn is approaching. If the estimated wait time exceeds a predefined threshold, the system can send a text message to the customer’s phone, notifying them that their number will be called soon.

This feature allows customers to manage their time better, as they can leave the branch and return just before their turn, rather than waiting in the lobby. Additionally, customers can scan a QR code on their ticket to track their position in the queue in real-time via their smartphones. This transparency and convenience enhance the customer experience, making the wait less burdensome.

8. Multilingual Interface

In a globalized world, many banks operate in regions with diverse linguistic populations. To cater to this diversity, EQS can be equipped with a multilingual interface. Customers can select their preferred language when registering at the terminal, and all subsequent communications, including printed tickets, SMS notifications, and voice prompts, will be provided in that language.

This feature is particularly important in countries with multiple official languages or in international banks that serve a global clientele. By offering services in the customer’s preferred language, banks can remove barriers to communication, making their services more accessible and inclusive.

Case Study: Aristostar’s Impact in the UAE

In the United Arab Emirates (UAE), companies like Aristostar have been at the forefront of implementing Queue and Visitor Management Systems, which include Electronic Queue Systems as a core component. Aristostar’s solutions are designed to enhance customer experience through features like pre-booking, advanced analytics, and digital signage. With over a decade of experience and hundreds of successful installations, Aristostar has built a strong reputation for providing high-quality products and excellent after-sales service.

In a region known for its diverse population and fast-paced economic growth, the ability to manage customer flow efficiently is crucial. Aristostar’s systems have been instrumental in helping banks in the UAE improve their service delivery, reduce wait times, and enhance customer satisfaction. By integrating advanced technologies like EQS, banks can stay ahead in a competitive market, offering services that meet the needs of modern customers.

The Future of Electronic Queue Systems in Banking

As technology continues to evolve, so too will the capabilities of Electronic Queue Systems. Future developments may include the integration of artificial intelligence (AI) and machine learning to predict customer needs and optimize service delivery further. For example, AI could analyze customer data to anticipate peak times and adjust staffing levels accordingly, or recommend additional services to customers based on their previous interactions with the bank.

Moreover, the rise of omnichannel banking—where customers interact with their bank through various channels, including online, mobile, and in-branch—will likely drive the development of more sophisticated EQS that can seamlessly integrate these channels. This would allow customers to start a transaction online, continue it via mobile, and complete it in-branch without any disruption in service.

Conclusion

The implementation of Electronic Queue Systems in banking has brought about significant improvements in both customer service and operational efficiency. These systems automate and optimize the service process, ensuring that customers receive timely, personalized, and high-quality service. With features like workstation specialization, service routing, client prioritization, and multilingual interfaces, EQS is transforming the way banks operate, making them more responsive to the needs of modern customers.

In regions like the UAE, where customer expectations are high, companies like Aristostar have demonstrated the tangible benefits of EQS through successful implementations that enhance the customer experience and streamline operations. As technology continues to advance, EQS will play an increasingly vital role in the future of banking, helping financial institutions to stay competitive, efficient, and customer-focused.

Hockey fan, tattoo addict, hiphop head, Eames fan and independent Art Director. Operating at the intersection of art and purpose to give life to your brand. I work with Fortune 500 companies and startups.